Eurazeo

Power Better Growth

Type d'entreprise

Grande entreprise

Secteur

Banque / Finance

A promising future for Tech M&A

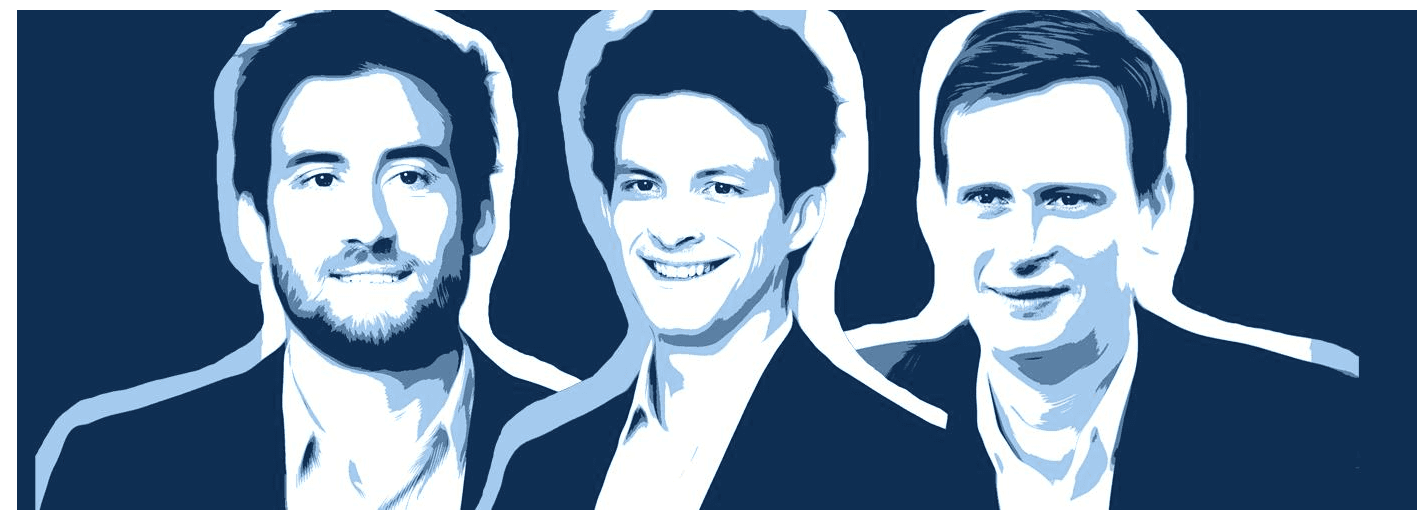

Despite the dramatic slowdown in tech M&A dealmaking this year, several factors continue to provide strong incentives for European entrepreneurs and their investment backers to pursue consolidation, argue Romain Mombert, Pierre Meignen, and Olivier Sesboüé

Future consolidation in the tech industry to respark M&A dealflow

The number and value of tech sector M&A transactions have dropped markedly since the middle of last year, hit by higher interest rates, stock market volatility in the tech sector, and a slowdown in private equity fundraising.

In Europe, according to Dealogic, the number of deals in the first six months of 2023 was just 27, half the number recorded in H1 2022, for a total value of $30 billion down by about a quarter from $43 billion in H1 2022.

That’s a steep fall, but the market is far from dead, and tech investors need not despair of seeing their portfolio companies engage in M&A deals going forward, given how many positive reasons there are for ambitious tech entrepreneurs and shareholders to pursue industry consolidation.

What follows represents a handful of the factors that we consider will continue to drive deal-making in the European tech sector.

Bulking up to create global champions

One powerful factor that will continue to drive tech M&A is the race to build dominant players in some emerging, but still fragmented, tech sectors such as online marketplaces, software, digital business services, and gaming.

With everything still to play for, entrepreneurs are likely to aggressively pursue geographic expansion into new national markets, angling for a “winner-takes-all” endgame as they snap up local players to create a regional or even global champion.

Economies of scale to boost profitability

In addition to expanding the serviceable market, “build-up” transactions can also help management teams accelerate their push for profitability by providing economies of scale, for example by rationalizing their research & development efforts, or in merging their sales forces. This is especially true in a context in which tech companies are not exclusively focused on top-line growth and are intently eyeing profitability.

Another tangible advantage in acquiring rival companies in the tech sector, notably in software, is the potential for adding new adjacent clients and/or products to one’s own client lists and sales catalogs, thus opening the prospect of boosting profit margins by “cross-selling” new products to existing clients.

The race for talent

The HR challenge of finding digital-savvy, business-oriented employees has become a major headache for many entrepreneurs since the Covid pandemic, as they have struggled to keep pace with the booming demand in sectors like e-commerce, remote working tools, and gaming.

As a result, many entrepreneurs today complain that they can’t find the well-trained talent they need to continue to grow their companies. Although pressures on tech talent recruitment have eased somewhat since the pandemic, the shortage is ever increasing in booming sectors like AI and provides yet another incentive to pursue M&A acquisitions, namely in the shape of “talent-driven” deals dubbed “acqui-hires”.

European push for tech sovereignty

A specifically European factor that provides a positive tailwind for dealmaking in the region is the willingness of several national governments – and indeed the European Investment Fund, with its pan-European Scale-up Initiative - to encourage state-sponsored investment in a bid to build regional tech champions to counterbalance the US and Asian tech giants.

France was an early player in this trend, with its Tibi initiative launched in 2019, which aimed at encouraging institutional investors to allocate funds to the national tech sector. The first round of the Tibi initiative raised an initial €6 billion of late-stage funds, and this year it has been followed by plans for a second tranche of €7bn, targeting early-stage, deep tech, and cleantech investments.

That French program has now been followed by an ambitious UK government plan announced in July to encourage the country’s largest pension schemes to allocate 5% of their assets to unlisted equities within the next seven years.

Admittedly, most of these initiatives are backing VC and growth funds, so will not immediately boost the M&A tend, but will likely create M&A opportunities further down the line, within five to 10 years.

For some, a requirement to sell

One factor that could sustain or even resuscitate the pace of tech M&A is the need for some smaller companies to sell. This will be because some smaller or weaker growth companies may find themselves short of cash in coming months, as their private equity backers hold back on follow-up funding rounds in order to conserve their “dry powder” until such time as their own backers – or limited partners – themselves reopen their gates to further fundraising rounds.

Faced with the need for cash, an M&A sale might well be some tech entrepreneurs’ best, or only, option for survival.

Reasons to believe the M&A market will bounce back

There are several additional reasons to be confident that the tech M&A market will bounce back, over and above the strategic factors driving the entrepreneurs themselves to pursue deals.

One such factor will be an eventual recovery in the stock market valuations of listed tech stocks. This would have the advantage of allowing a change in attitude among institutional investors, who need to keep a careful eye on the relative allocations they make to listed and unlisted markets.

Secondly, the venture capital and private equity funds have important stocks of “dry powder” money, available to back transactions when deal flow picks up again.

A third factor that might spark a new round of dealmaking could be the uptick in profitability among many of the more ambitious tech companies, making them attractive targets for sponsor-backed acquisitions.

This will be the result of the recent shift in approach among many growth tech companies – and their backers – today putting greater emphasis on the importance of earnings-related KPIs than the previous focus on revenue growth alone. Concerns about inflation and the pressure of high interest rates have encouraged many companies to look more closely at how to right-size their teams, cut back on their less-promising markets, or re-examine their pricing models to reach profitability more rapidly than they would have at in the previous “easy-money” period.

As a result, when the tech M&A wave picks up again, as it certainly will, there will likely be many attractive targets for ambitious and opportunistic acquirers looking to build the future champions of their industry sectors.